There’s been a lot of talk lately about how a government shutdown impacts the housing market. You might be wondering: Is it causing everything to grind to a halt?

The short answer? No.

The housing market doesn’t stop. It keeps moving. Homes are still being bought and sold, contracts are still being signed, and closings are still happening. The difference is that a few parts of the process may slow down a little, but overall, the market continues to function.

Here’s What Typically Happens

Whenever the government shuts down, some federal agencies temporarily close or scale back their operations. That can cause a few hiccups in real estate, especially when it comes to processing certain types of government loans and insurance requirements:

- “Applicants for FHA, VA, or USDA loans—which account for about one-quarter of all mortgage applications—may encounter significant processing delays due to agency furloughs.” – Selma Hepp, Chief Economist at Cotality

- “By recent estimates, more than 2,500 mortgage originations per working day are at risk of delays during a shutdown . . .” – Zillow.

- Flood insurance approvals may also be paused. The National Flood Insurance Program can be temporarily affected, which delays closings in flood zones.

Even with those challenges and delays, most transactions still go through. Buyers keep buying, sellers keep selling, and agents continue to help people move forward.

The Housing Market Usually Bounces Back Fast

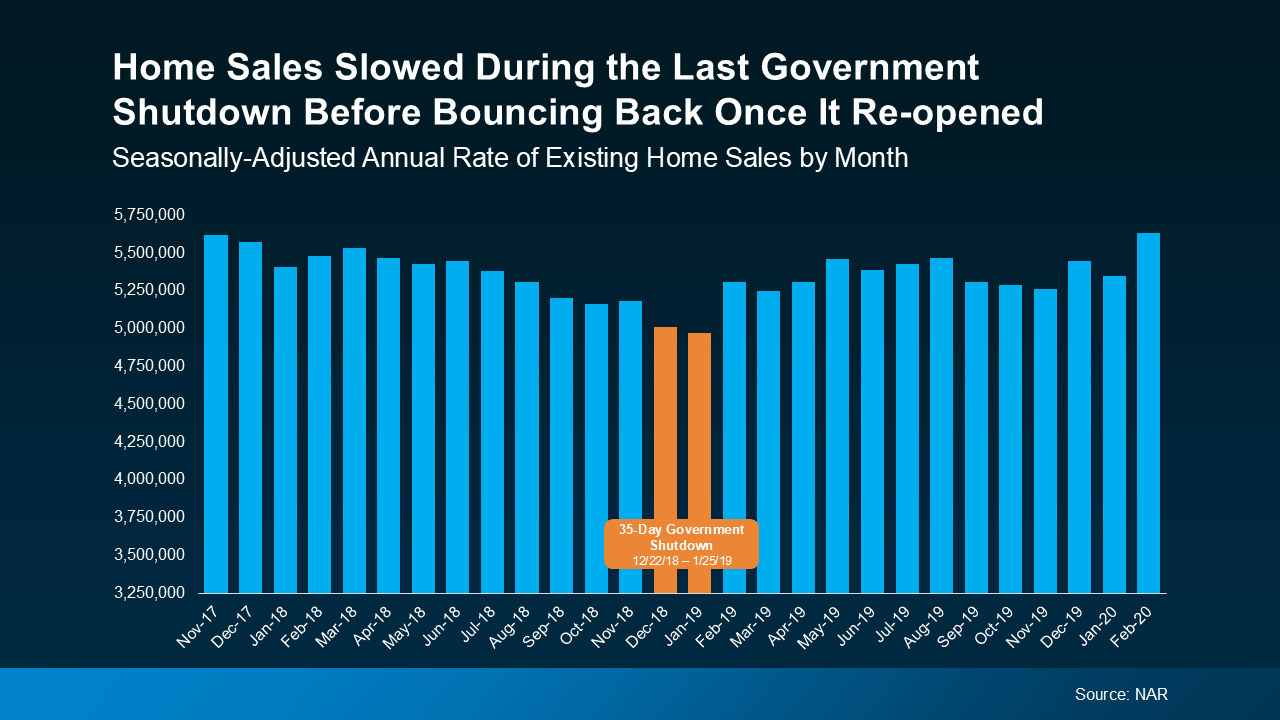

And you can see that play out in this data. If you look back at the most recent government shutdown, which began at the end of 2018 and lasted for 35 days, sales activity dipped slightly during the closure but rebounded quickly once the government reopened.

Data from the National Association of Realtors (NAR) shows existing home sales slowed for about two months, and then rebounded quickly as delayed closings worked their way through the system when the government reopened (see graph below):

What’s important to note is that the slowdown you see in the orange bars on this graph wasn’t simply due to seasonality in a typical housing market cycle. The sharper, shorter drop in this case lines up precisely with the 35-day government shutdown, and then sales bounced back as soon as it ended.

What’s important to note is that the slowdown you see in the orange bars on this graph wasn’t simply due to seasonality in a typical housing market cycle. The sharper, shorter drop in this case lines up precisely with the 35-day government shutdown, and then sales bounced back as soon as it ended.

What This Means for You

If you’re in the middle of buying or selling a home, don’t panic. Most deals will still move forward, even if it takes a few extra days. Jeff Ostrowski, Housing Market Analyst at Bankrate, explains:

“If you’re expecting to close in a week or a month, there could be some slight delay, but I think for most people, it’s probably going to be a blip more than a real deal killer.”

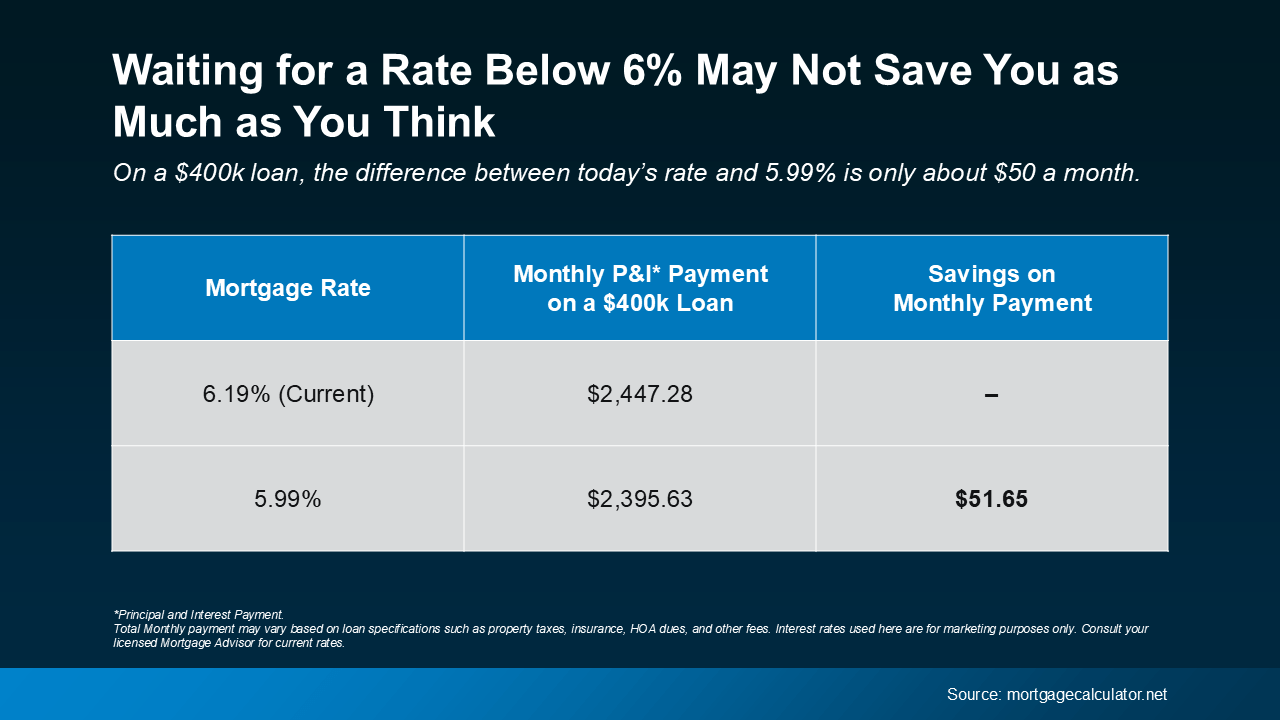

And if you’re starting to think about buying or selling, this could actually work in your favor. Some buyers and sellers may become cautious and pause their plans during times of uncertainty, like this, and that can open a short window of opportunity.

When fewer people are active in the market, well-prepared buyers may find less competition for homes, and motivated sellers may be more willing to negotiate. These brief slowdowns often create a moment where you can make a move that would be harder once activity ramps back up.

Bottom Line

A government shutdown can cause short-term delays for some buyers, but it doesn’t derail the housing market. The last time this happened, sales rebounded as soon as the government reopened. If you’re unsure how this might affect your plans, or want to make sense of what’s happening, let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

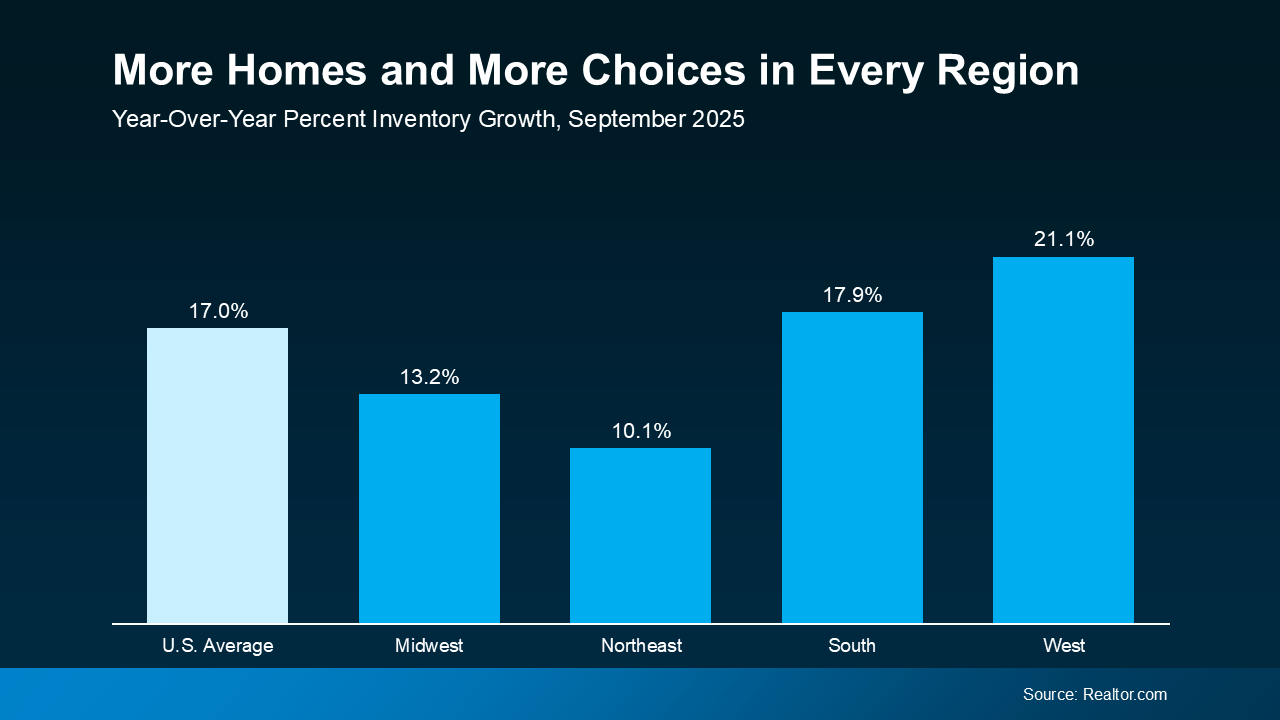

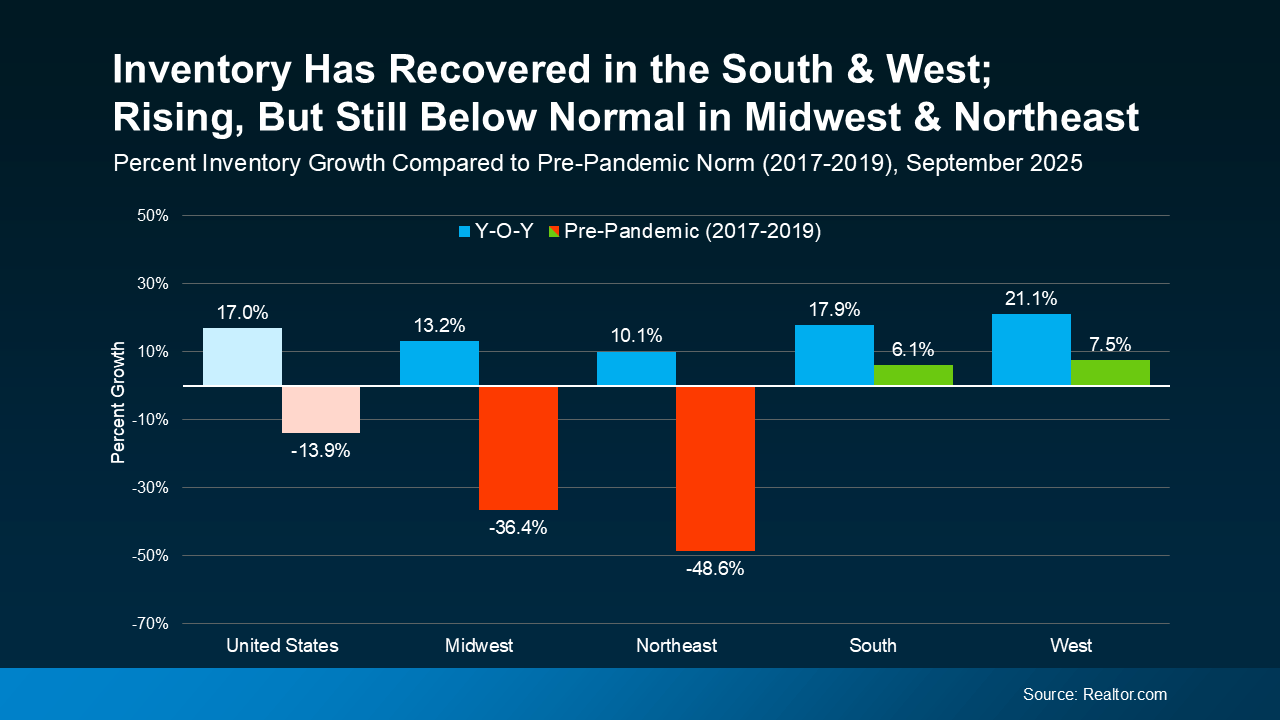

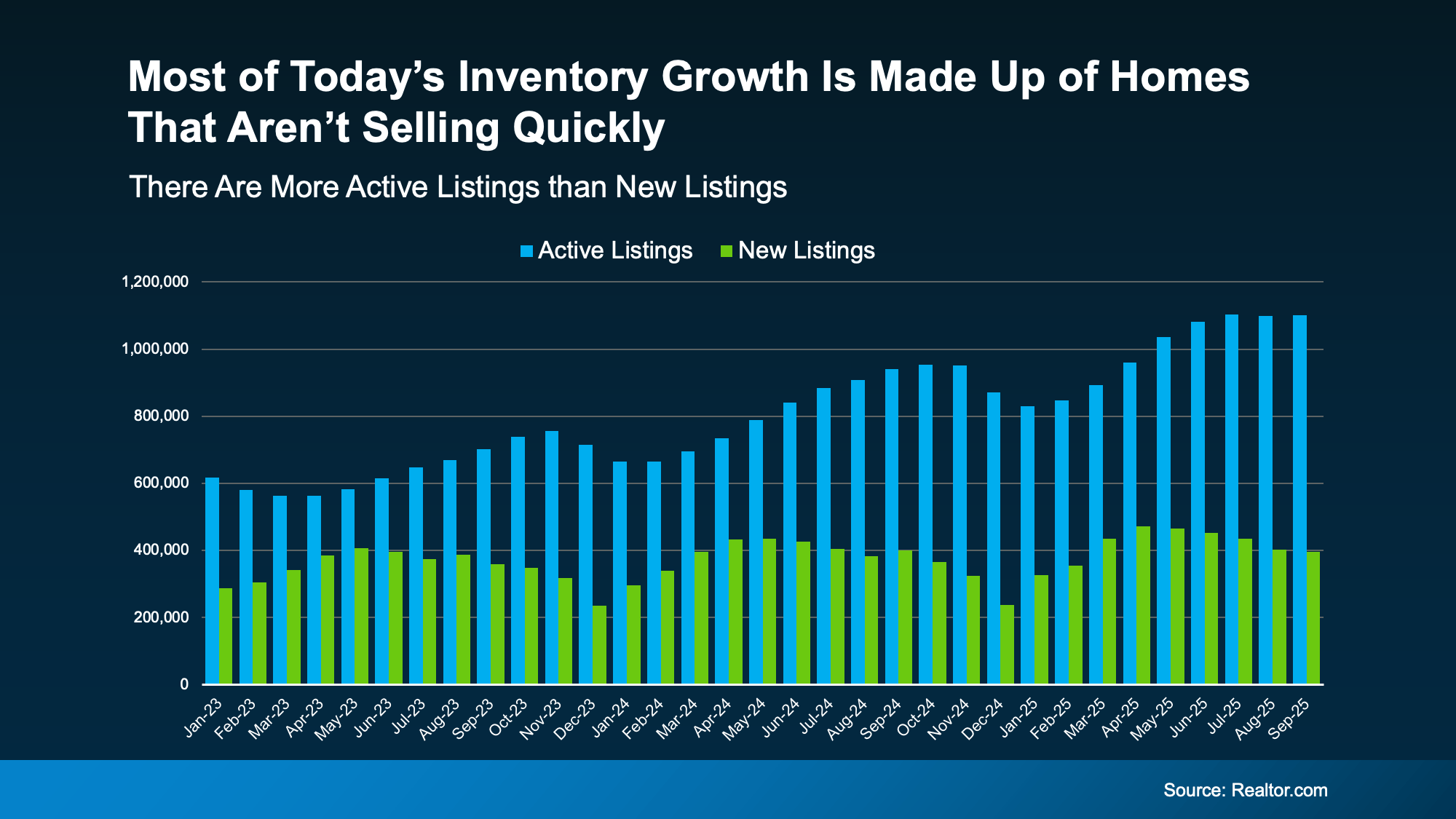

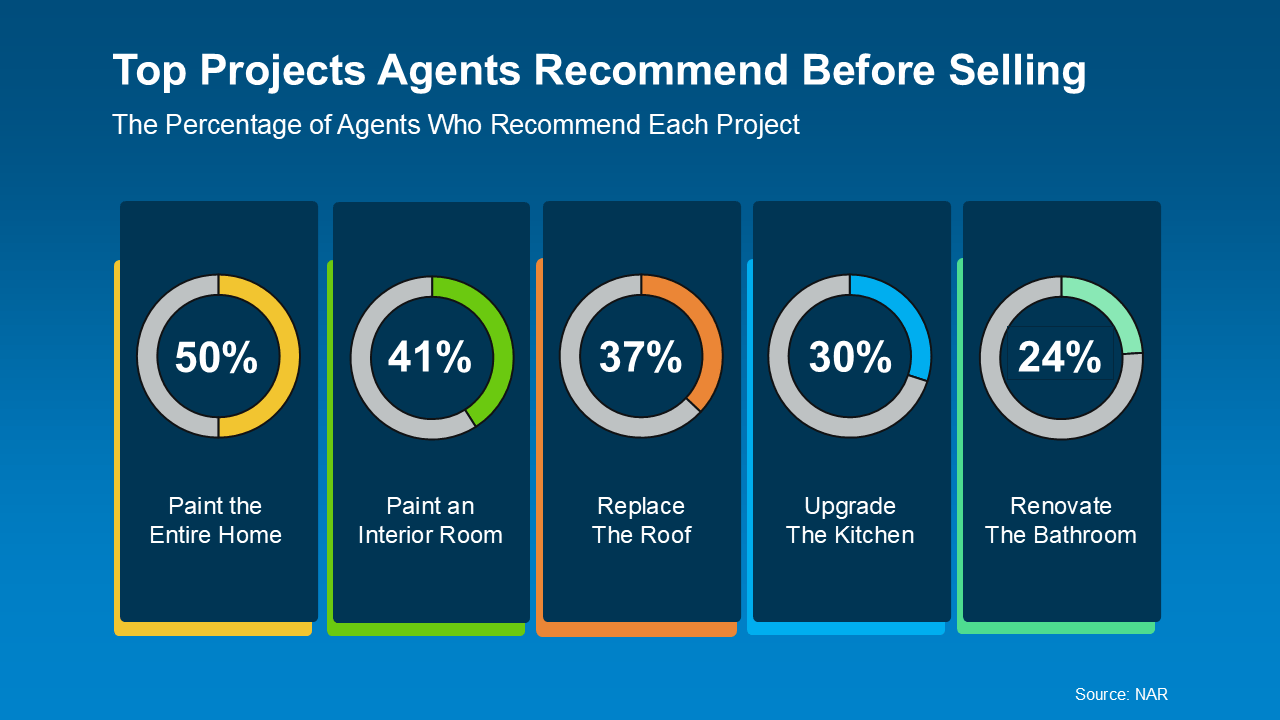

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.