Would-be homebuyers aren’t sitting on the sidelines because they don’t want to buy. They’re sitting out because they think they can’t. And sometimes, it’s their credit score that’s holding them back.

According to a Bankrate survey, 2 out of every 5 (42%) Americans believe you need excellent credit to qualify for a mortgage. That may be why, when renters are asked why they don’t own yet, “my credit isn’t good enough” comes up often.

Maybe you’re in the same boat. You look at your score, see it’s not where you want it to be, and assume buying your first place just isn’t realistic right now.

But here’s what you need to know.

Even though a lot of people assume you need flawless credit to buy a house, that’s not necessarily the case.

You Don’t Need Perfect Credit To Buy a Home

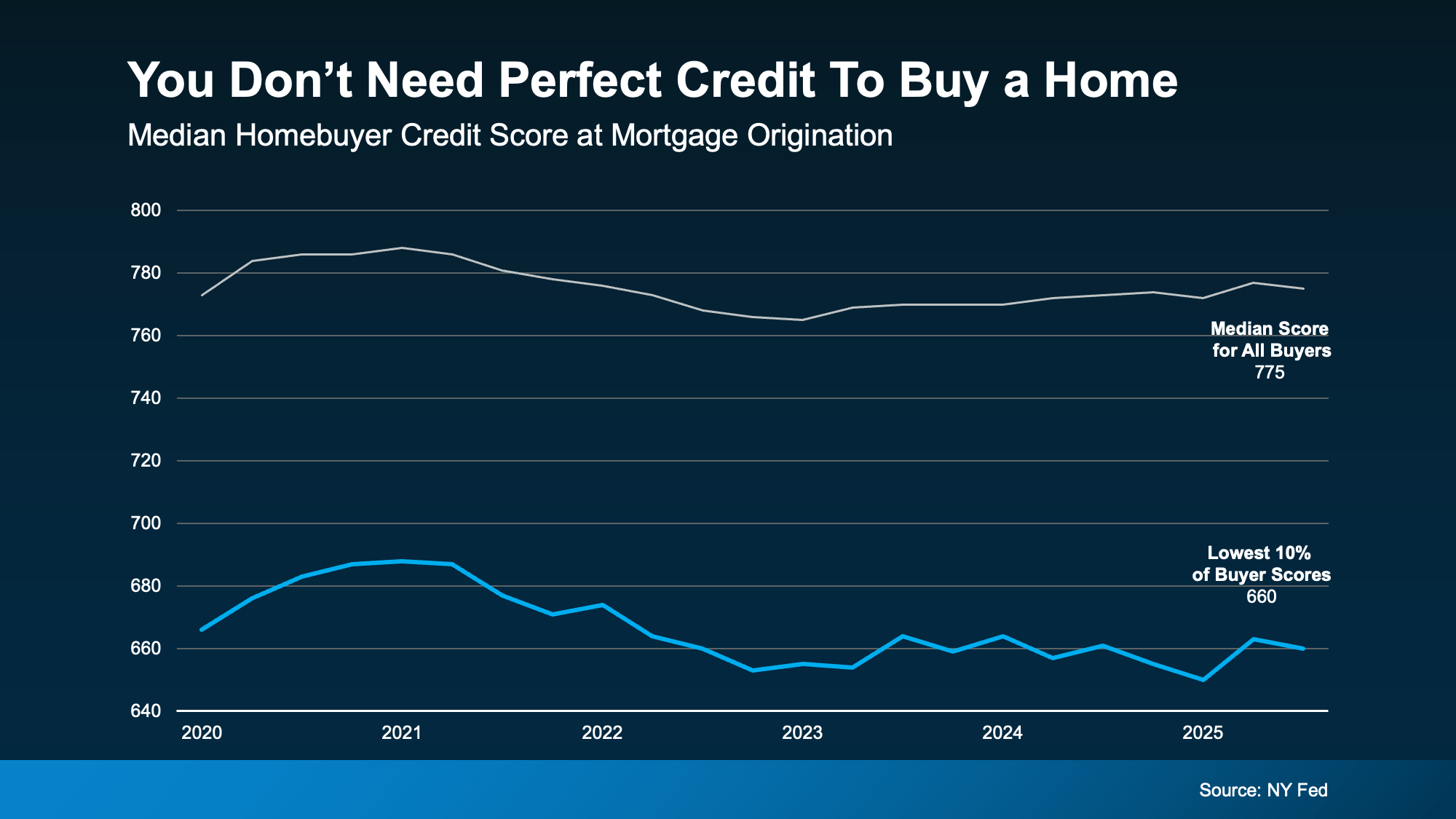

So, where’s this myth come from? Part of the confusion stems from the fact that the typical homebuyer today does have a reasonably strong credit score. In fact, according to data from the NY Fed, the median credit score for all buyers is 775.

But that doesn’t mean you need a score that high to qualify.

Looking at recent homebuyers, a number were able to get a mortgage with scores below that threshold. Data shows 10% of scores were around 660. Which means some were higher than that, and some were lower, but the median in that lowest 10th percentile was around that range (see graph below):

So, even if your score isn’t as high as you want, that doesn’t automatically close the door. FICO explains there is no universal credit score you absolutely have to have when buying a home:

So, even if your score isn’t as high as you want, that doesn’t automatically close the door. FICO explains there is no universal credit score you absolutely have to have when buying a home:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use . . .”

The best thing to do is to talk to a trusted lender to see what’s possible for you. Because some buyers are buying with scores in the 600s, maybe that means you can too.

Bottom Line

Your credit score is essential. But that doesn’t mean it has to be perfect.

If credit has been the reason you’ve been waiting to buy a home, it might be time to take another look at your options. If you want help understanding where you stand and what your next step could be, connect with a local lender.

You don’t need to have everything figured out to start the conversation.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

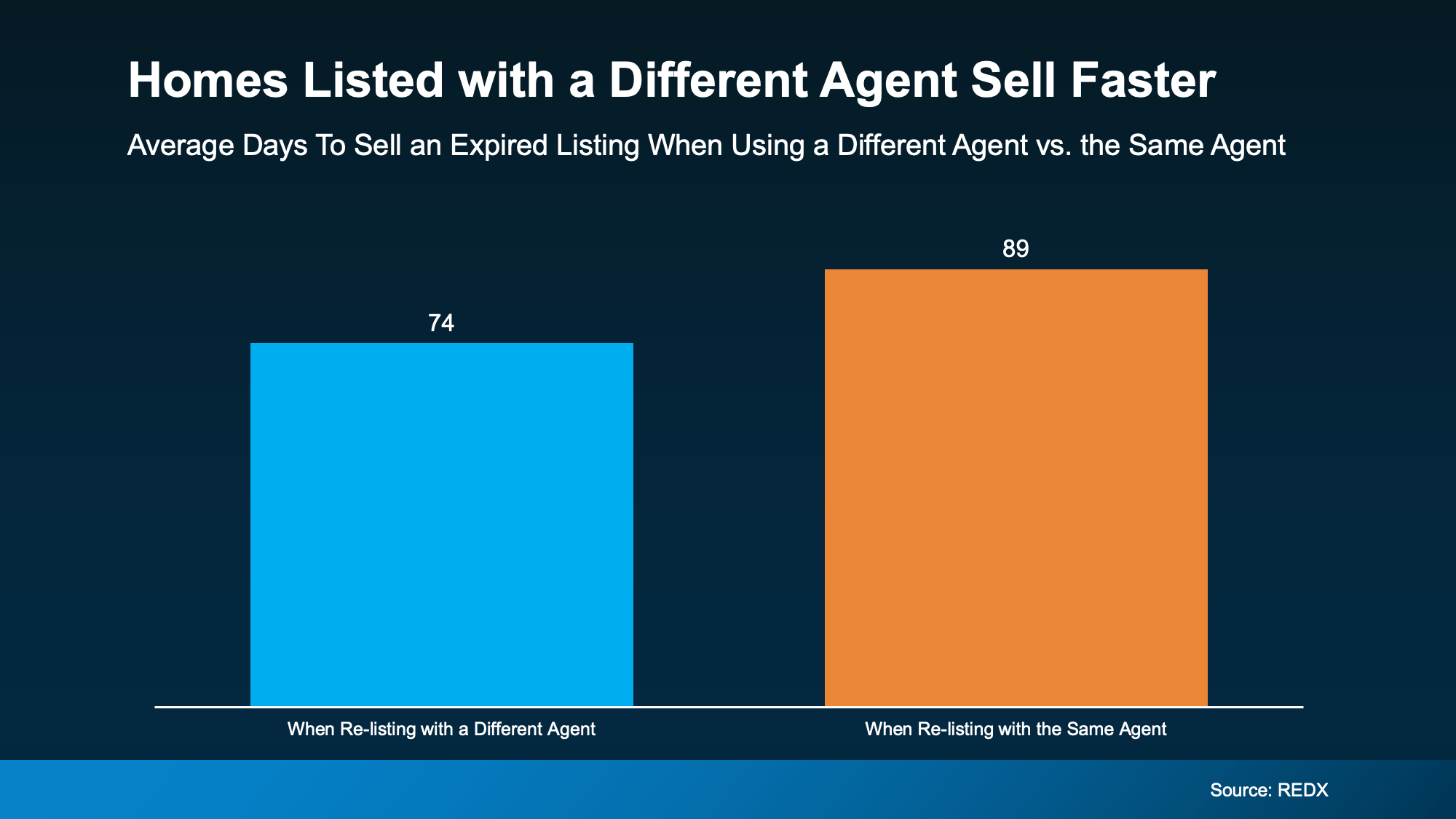

How an Agent Can Help

How an Agent Can Help

The Fix: Get a fresh pricing analysis rooted in what’s happening right now in your neighborhood – not what happened in 2021. Sometimes even a small adjustment can bring the right buyers through the door. HousingWire reports many successful sellers only had to reduce their price by about 4% to get real traction. In the grand scheme of selling a home, it’s really not that much.

The Fix: Get a fresh pricing analysis rooted in what’s happening right now in your neighborhood – not what happened in 2021. Sometimes even a small adjustment can bring the right buyers through the door. HousingWire reports many successful sellers only had to reduce their price by about 4% to get real traction. In the grand scheme of selling a home, it’s really not that much. 4. You Weren’t Willing To Negotiate

4. You Weren’t Willing To Negotiate