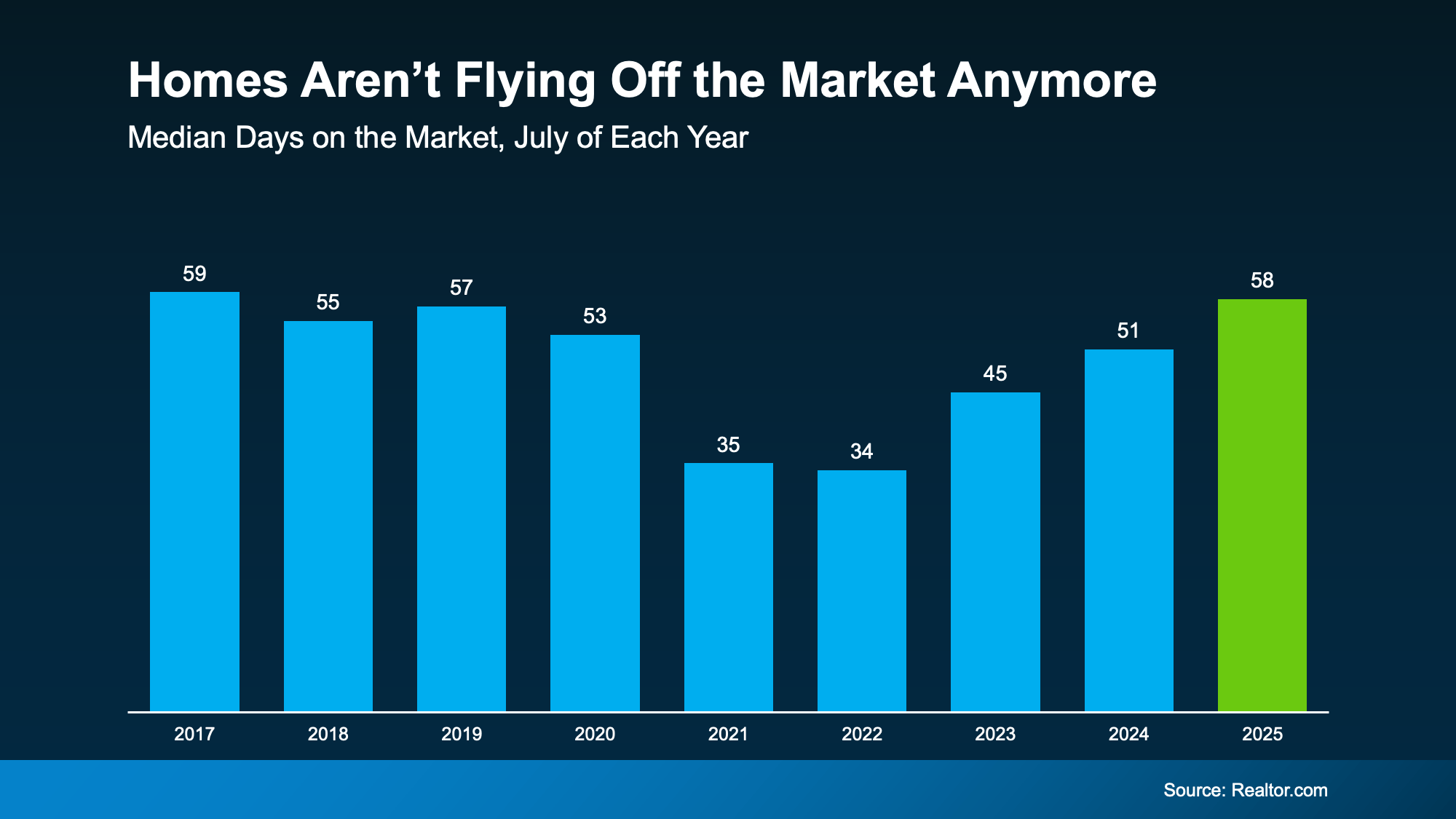

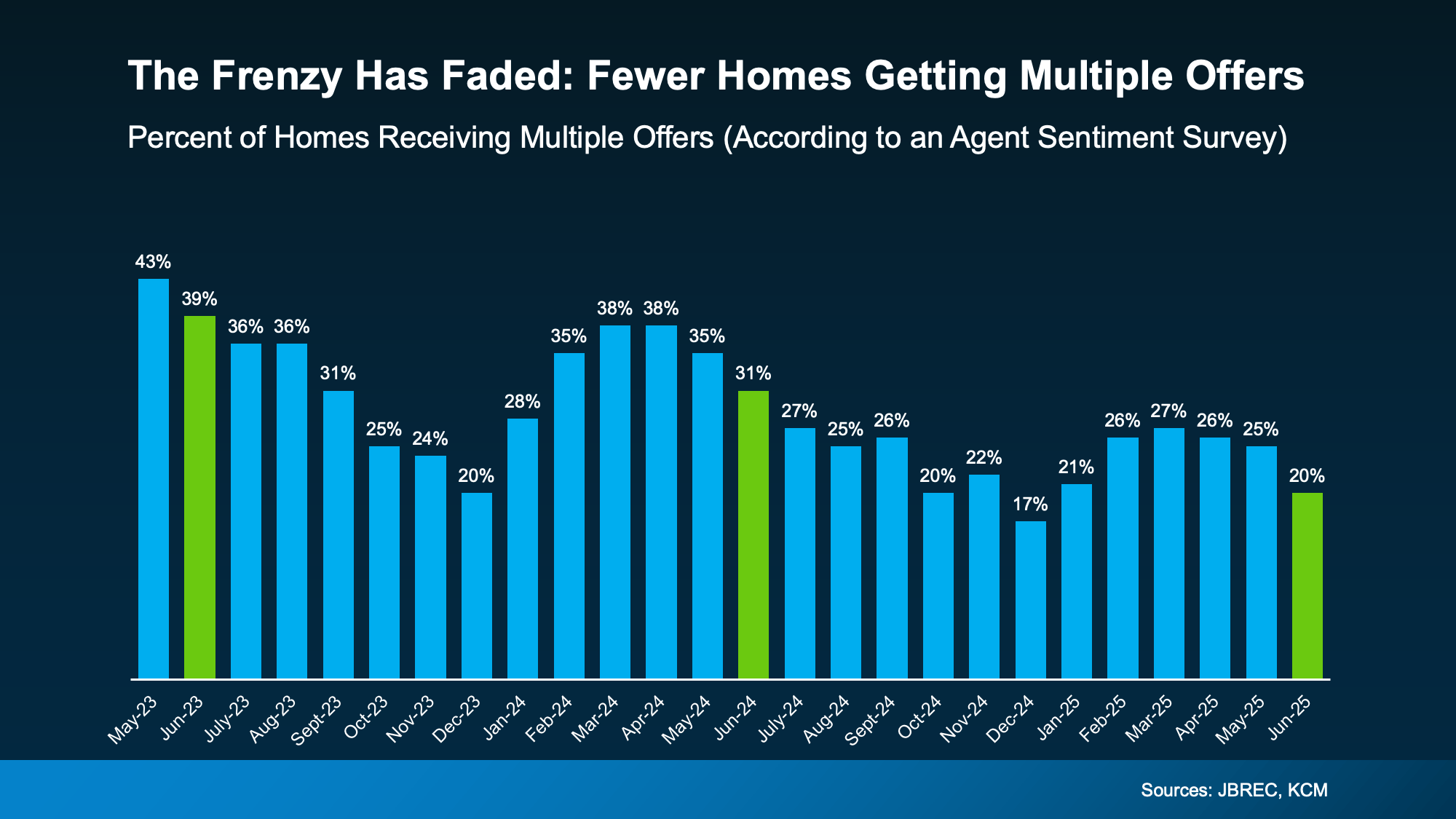

If you’re still worried about having to deal with a bidding war when you buy a home, you may be able to let some of that fear go.

While multiple-offer situations haven’t disappeared entirely, they’re not nearly as common as they used to be. In fact, a recent survey shows agents reported only 1 in 5 homes (20%) nationally received multiple offers in June 2025.

That’s down from nearly 1 in 3 (31%) just a year ago – and dramatically lower than in June 2023 (39%) (see graph below):

This trend means you should face less competition when you buy. That gives you more time to make decisions and the ability to negotiate price or terms.

This trend means you should face less competition when you buy. That gives you more time to make decisions and the ability to negotiate price or terms.

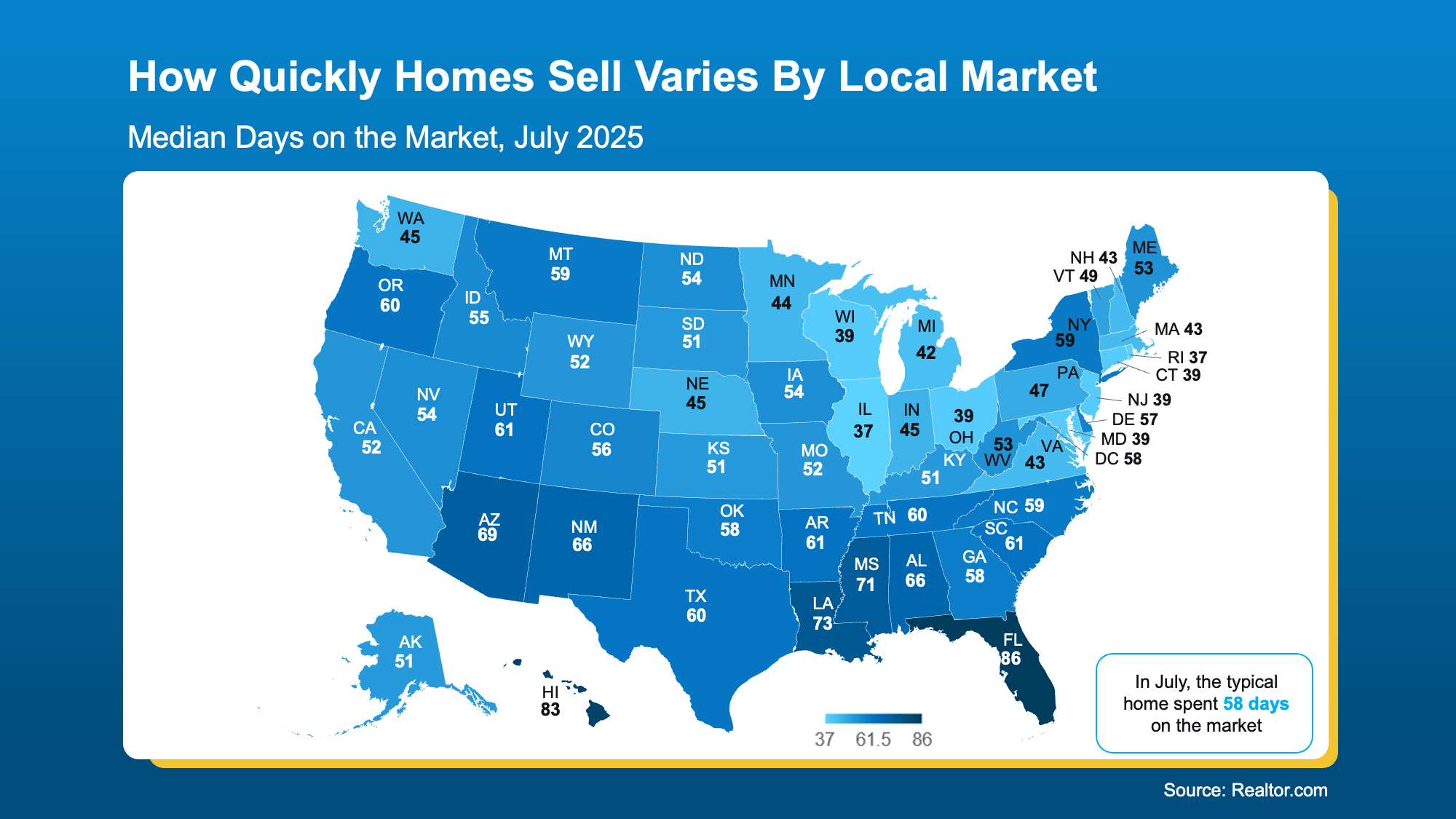

It Still Depends on Where You’re Buying

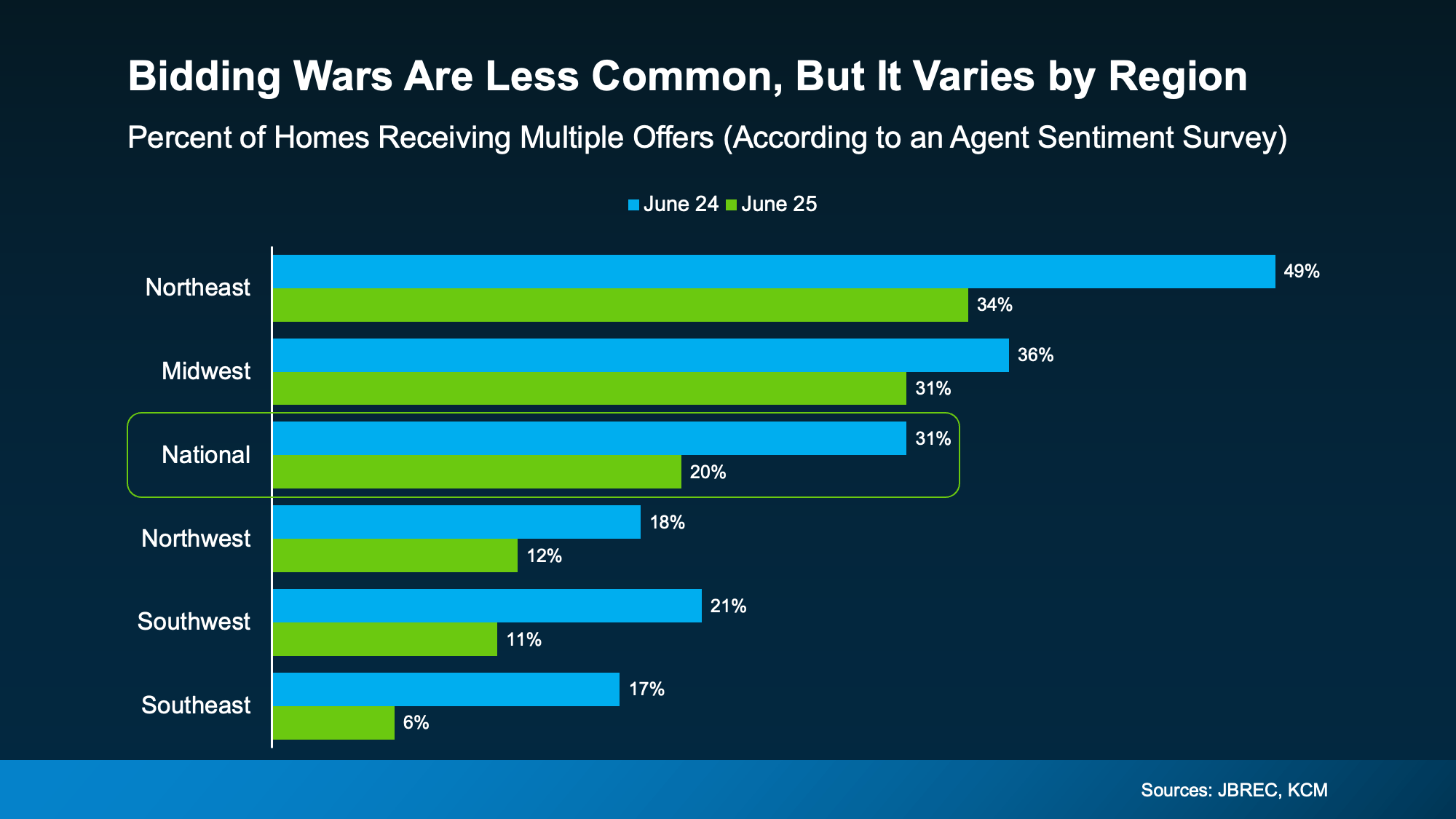

Of course, national trends don’t tell the whole story. Local dynamics matter a lot. This second graph uses survey data from John Burns Research & Consulting (JBREC) and Keeping Current Matters (KCM) to break things down by region to prove just how true that is. It shows that, while the share of homes getting multiple offers has dropped pretty much everywhere, some areas are still seeing more offers than others:

In the Northeast, 34% of homes (roughly 1 in 3) are still receiving multiple offers. That’s more than the national average. But in Southeast, that number drops to just 6%.

In the Northeast, 34% of homes (roughly 1 in 3) are still receiving multiple offers. That’s more than the national average. But in Southeast, that number drops to just 6%.

What’s behind the difference? In general, the areas still seeing bidding wars tend to have lower-than-normal inventory. That imbalance between buyers and available homes keeps pressure on prices and competition. But markets with more listings are seeing conditions cool – and that means fewer bidding wars.

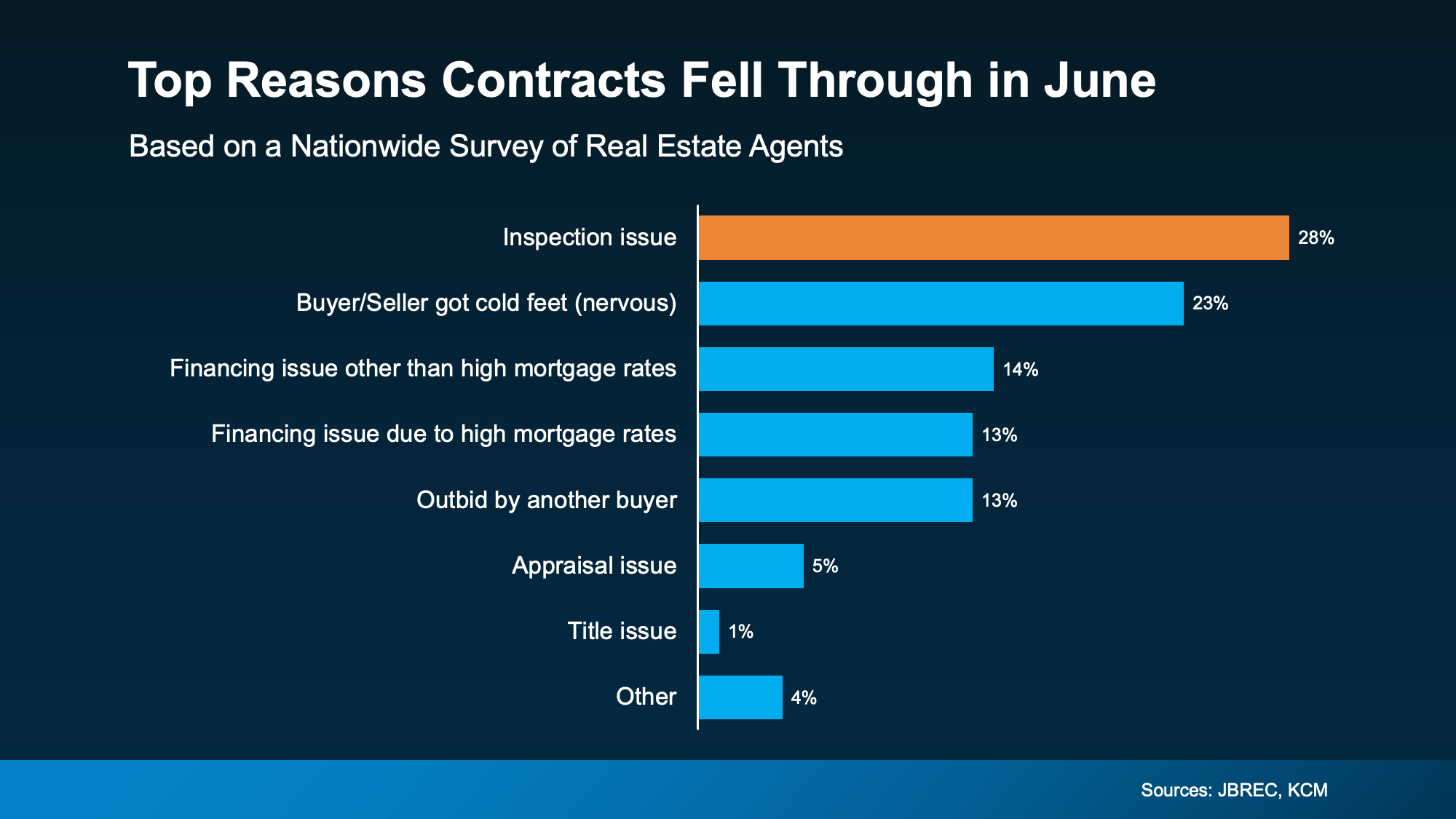

Sellers Are More Flexible Than You Might Think

Here’s another shift to show you just how much things have changed. According to a Redfin report, almost half of sellers are offering concessions, like covering their buyer’s closing costs or dropping their asking price to get their house sold.

That’s a clear sign this isn’t the same ultra-competitive market we saw a few years ago. Back then, sellers rarely compromised. Buyers often waived their inspection or appraisal to make their offer stand out. Now, things are different.

But again, how often this is happening is going to vary based on where you’re looking to buy. And that’s why you need a local agent’s expertise.

Bottom Line

If concerns about bidding wars have been holding you back, it may be time to take another look. Nationally, competition is down. In some markets, it’s down significantly. And with more sellers offering concessions, buyers today have more power and flexibility than they’ve had in a long time.

Want to find out what the market looks like where you’re buying? Let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link