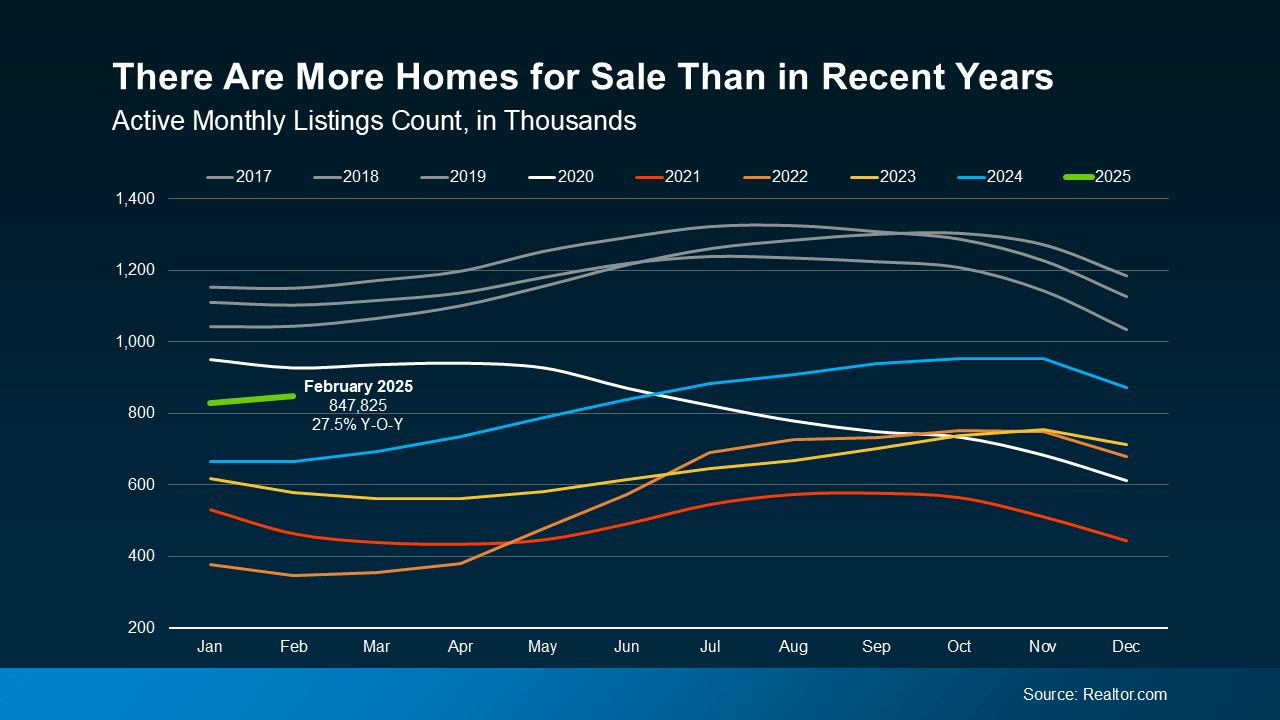

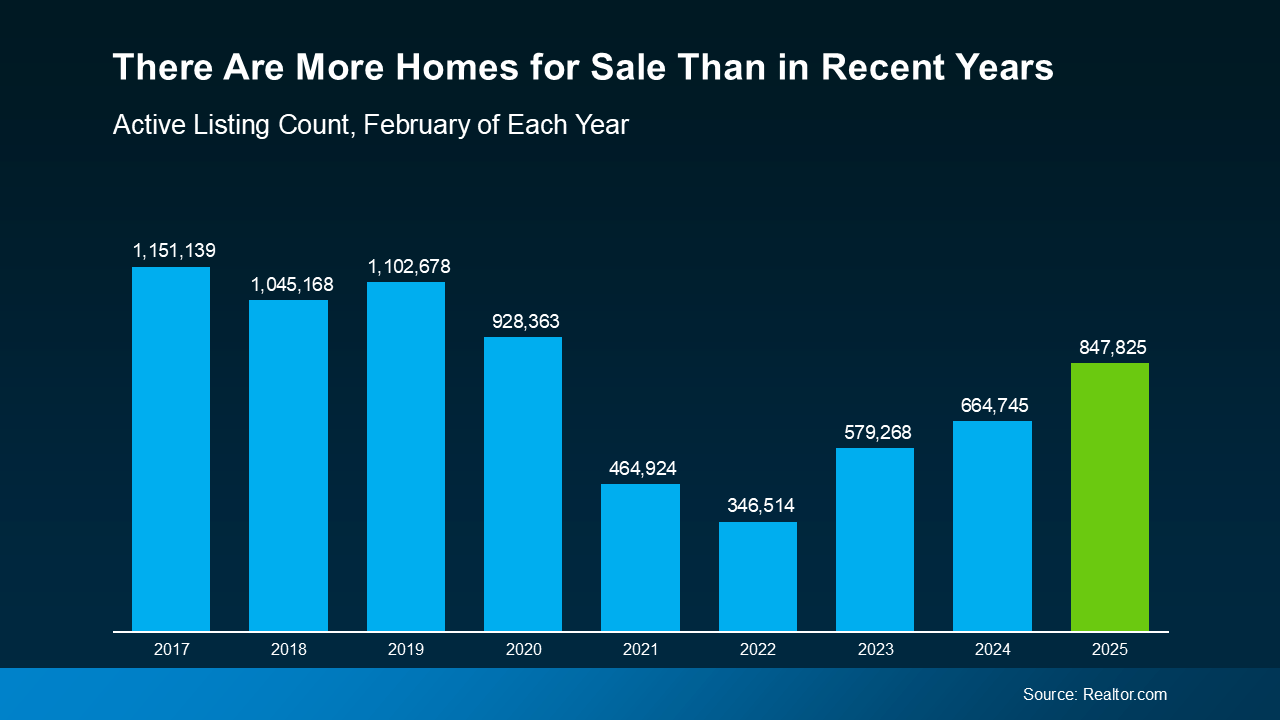

You may have heard there are more homes for sale right now. And while that’ll vary depending on the market, it means that overall, things are starting to lean in a more balanced direction. As that happens, some sellers are a bit more open to compromise. Here’s what that means for you.

You may be regaining some negotiating power. That can translate into savings, perks, or even better terms on your purchase – if you know what levers to pull during negotiation.

Why an Agent Is an Essential Part of the Negotiation Process

The complicated part is knowing what is and isn’t on the table. That’s where your agent comes in. According to the National Association of Realtors (NAR), besides finding the right home, buyers want their agent to help negotiate the terms of the sale, followed by negotiating the price.

Here’s why. Agents are skilled negotiators and are trained for moments like this. Since your agent is an expert on the local market, they’ll also know what’s working for other buyers (and what’s not), which can help you better understand what’s realistic to ask for.

What’s on the Negotiation Table?

Here are some of the most common concessions an agent can help you negotiate:

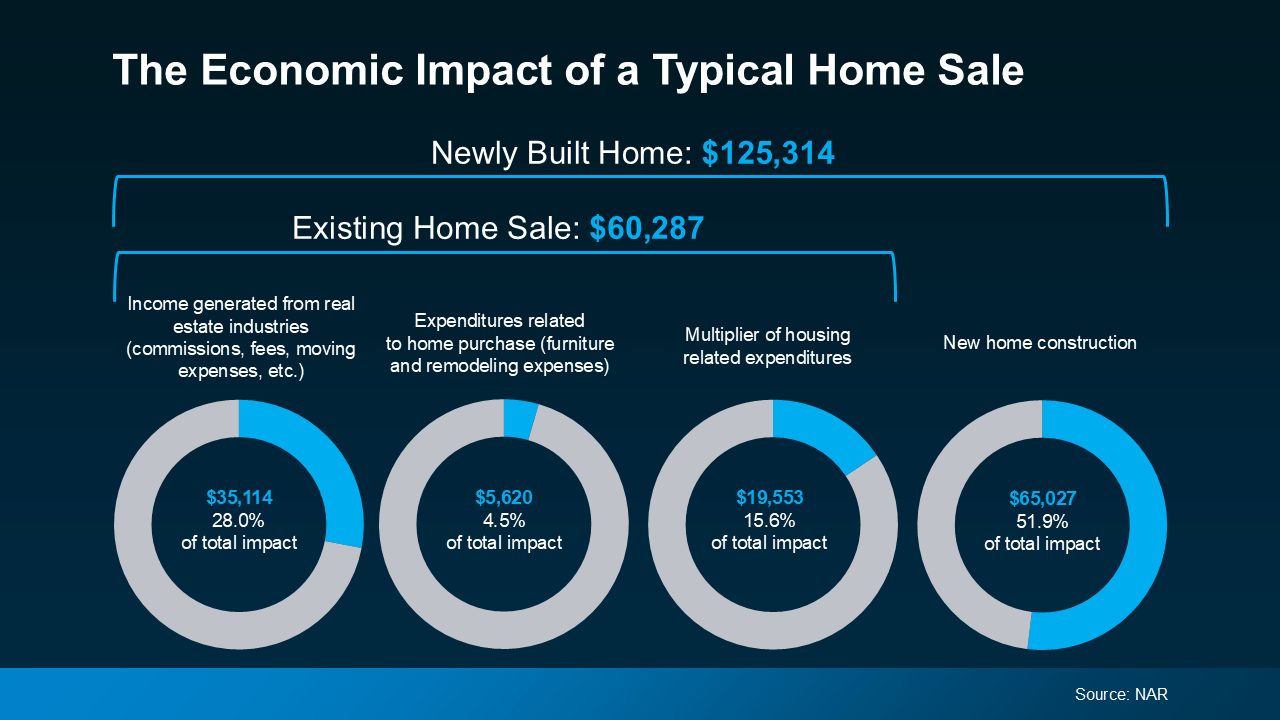

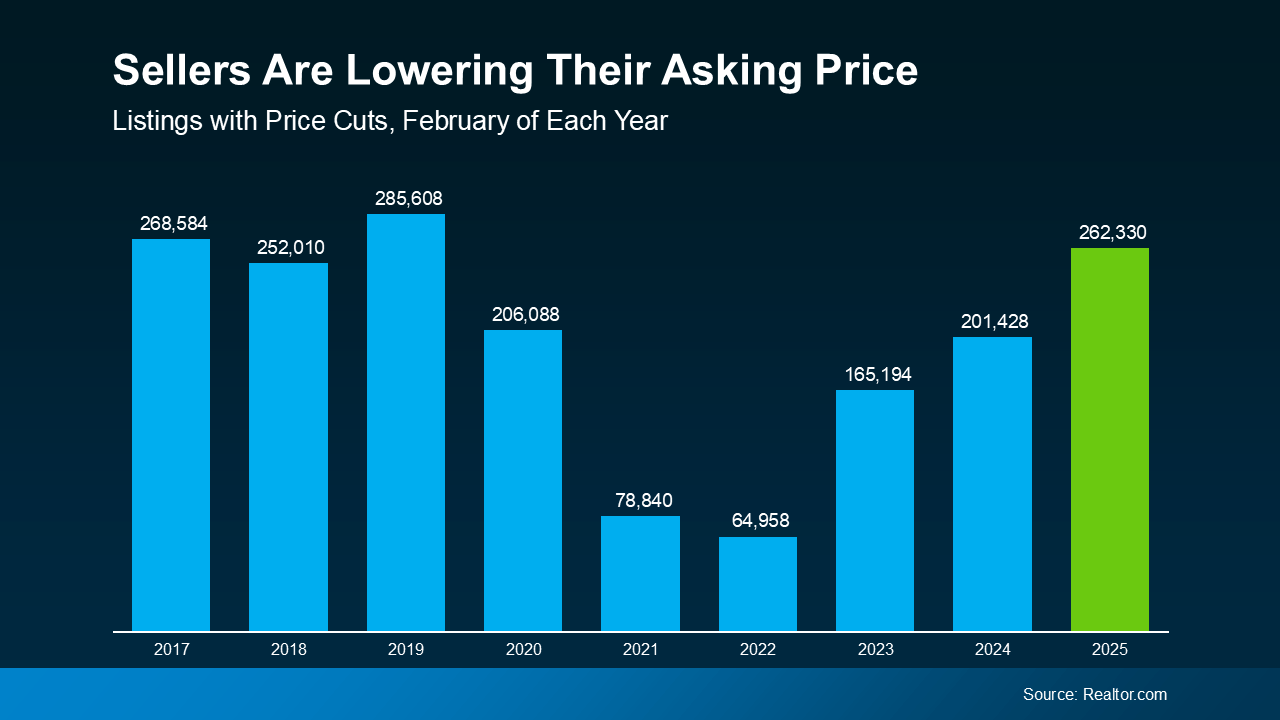

- Sale Price: The most obvious concession is the price of the home, and that lever is being pulled more often today. Buyers don’t want to overpay when affordability is already so tight, and sellers who aren’t realistic about their asking price may have to consider adjusting their price.

- Closing Costs: Closing costs are usually about 2-5% of a home’s purchase price and include fees for things like the appraisal, title insurance, and underwriting of your loan. To offset the cash you must bring, you can ask the seller to pay for some or all of these expenses. According to NAR, this was the most common concession sellers made in 2024.

- Home Warranties: If you’re worried about the maintenance costs that may pop up after you get the keys, you can ask the seller to pay for a home warranty. Since this concession usually isn’t expensive for the seller, it can be a good negotiation tool for a buyer. It’s not a significant cost for them, but it can be a big perk for you.

- Home Repairs: Based on the inspection, you can ask the seller to make repairs. If the seller doesn’t want to, they could offer to drop the home price or cover some closing costs, so you have more room in your budget to take care of the repairs yourself.

- Fixtures: Do you want that washer and dryer to stay? Maybe the stainless-steel fridge, too? In many cases, you can ask for appliances or even furniture to be included in the deal, which will save you money when you move in.

- Closing Date: The closing date is also negotiable. Based on your timeline, you may request a faster or extended closing window. Depending on the seller’s needs, this could also be great for their situation.

Of course, negotiating is a complex process. And not every seller will be willing to offer concessions. Again, lean on your agent for expert advice about what’s realistic to ask for and what could turn sellers off.

Because once you’ve found a home you love, you don’t want to risk losing it. But you also want to get the best terms on your purchase – and that’s where an agent can make all the difference.

Bottom Line

As inventory grows, buyers are finding they have a bit more leverage. Having the right agent by your side, who can help you approach negotiations strategically, is key.

What’s your biggest concern when negotiating with a seller? Let me know, and we’ll create a solid plan to make things less stressful.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Buyers: This means you have more choices and can be more selective.

Buyers: This means you have more choices and can be more selective. Buyers: Acting sooner rather than later could be smart before your competition heats up even more.

Buyers: Acting sooner rather than later could be smart before your competition heats up even more.

This is a sign sellers are more willing to compromise today. If you look back to more normal years in the market (2017–2019), you’ll see that the number of price cuts happening today is much closer to what’s typical – and for most buyers, that’s a significant relief.

This is a sign sellers are more willing to compromise today. If you look back to more normal years in the market (2017–2019), you’ll see that the number of price cuts happening today is much closer to what’s typical – and for most buyers, that’s a significant relief.

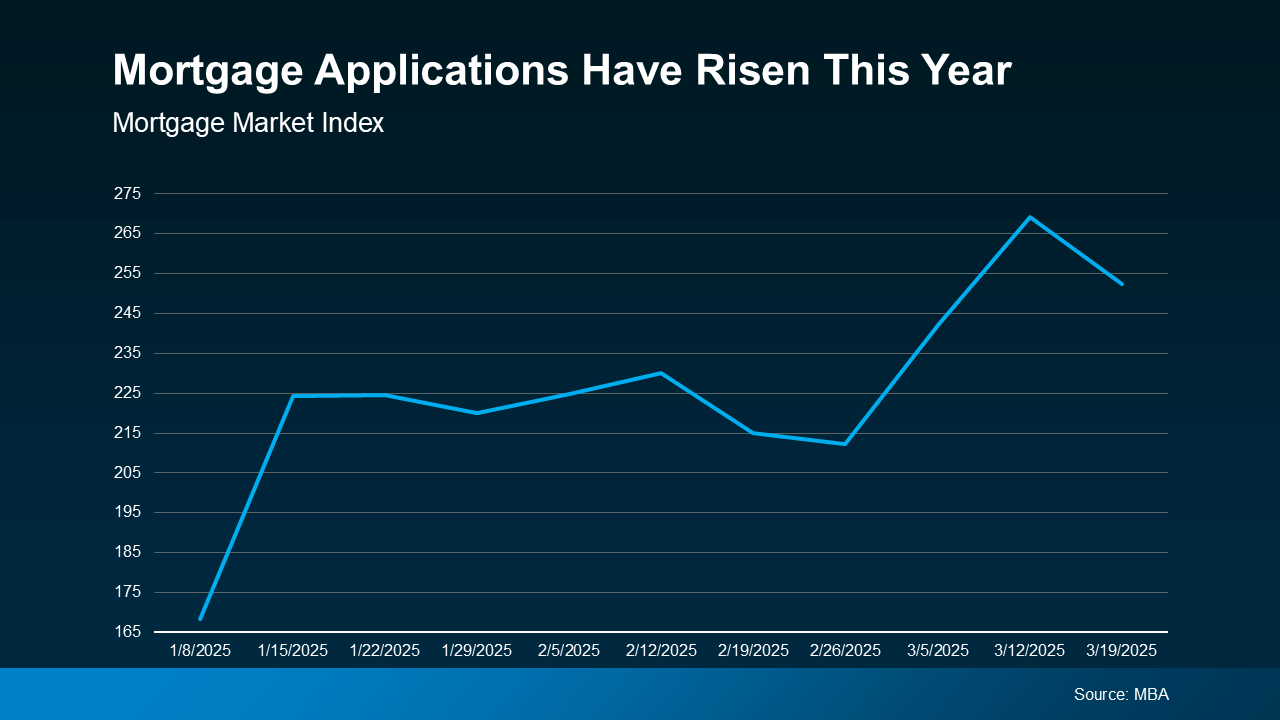

Where the Market Stands Now

Where the Market Stands Now Do you know how to adjust your plans based on who’s got the most negotiating power? Because an agent does.

Do you know how to adjust your plans based on who’s got the most negotiating power? Because an agent does.