If you’ve been following real estate news lately, you’ve probably seen headlines saying home prices are flat. And at first glance, that sounds simple enough. But here’s the thing. The reality isn’t relatively that straightforward.

In most places, prices aren’t flat at all.

What the Data Really Shows

While we’ve definitely seen prices moderate from the rapid and unsustainable climb of 2020-2022, the extent of the change will vary significantly everywhere.

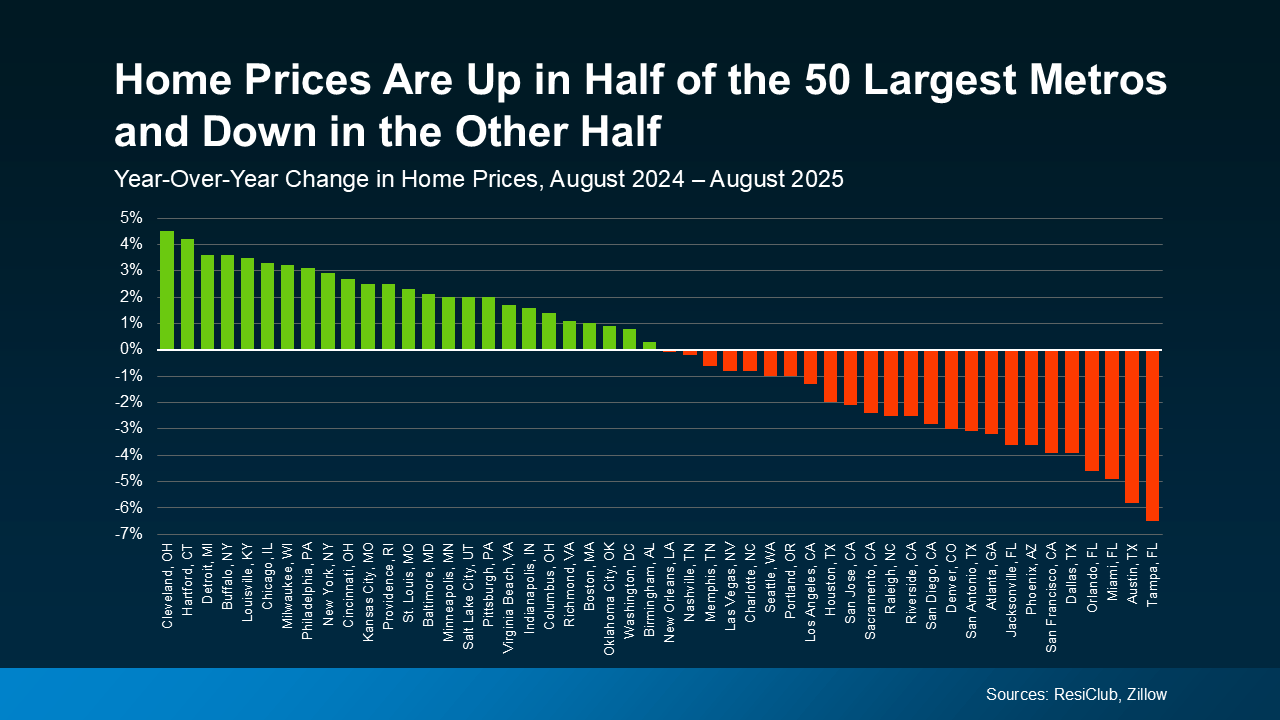

Examining data from ResiClub and Zillow for the 50 largest metropolitan areas reveals this trend clearly. The real story is split right down the middle. Half of the metros are still seeing prices inch higher. The other half? Prices are coming down slightly (see graph below).

The big takeaway here is “flat” doesn’t mean prices are holding steady everywhere. What the numbers actually show is how much price trends vary depending on your location.

The big takeaway here is “flat” doesn’t mean prices are holding steady everywhere. What the numbers actually show is how much price trends vary depending on your location.

One factor that’s driving the divide? Inventory. The Joint Center for Housing Studies (JCHS) of Harvard University explains:

“ . . . price trends are beginning to diverge in markets across the country. Prices are declining in a growing number of markets where inventories have soared while they continue to climb in markets where for-sale inventories remain tight.”

When you average those very different trends together, you get a number that appears to be flat. However, it doesn’t reveal the whole story, and it’s not what most markets are experiencing today. You deserve more than that.

And just in case you’re really focusing on the declines, remember those are primarily places where prices rose too much, too fast, just a few years ago. Prices have increased by roughly 50% nationally over the past five years, and even more in some markets experiencing a larger correction today. So, a modest drop in some local pockets still puts most of those homeowners ahead when it comes to the overall value of their home. Based on the fundamentals of today’s housing market, experts do not project a national decline in the future.

So, what’s actually essential for you to know?

If You’re Buying…

You need to know what’s happening in your area because that’s going to influence everything from how quickly you need to make an offer to how much negotiating power you’ll have once you do.

- In a market where prices are still rising, waiting around could mean paying more in the long run.

- In a market where they’re easing, you may be able to ask for things like repairs or closing cost help to sweeten the deal.

The bottom line? Knowing your local trend puts you in the driver’s seat.

If You’re Selling…

You’ll want to be aware of local trends, so you know how to price your house and what you can expect to negotiate.

- In a market where prices are still rising, you may not need to make many compromises to get your home sold.

- However, if you’re in a market where prices are decreasing, setting the right price from the start and being willing to negotiate becomes even more crucial.

The oversized action item for homeowners? Sellers need to have an agent’s local perspective if they want to avoid making the wrong call on pricing – and homes that are priced right are definitely selling.

The Real Story Is Local

The national averages can provide helpful context for broad trends. However, sometimes you need a local perspective because what’s happening in your zip code may look different. As Anthony Smith, Senior Economist at Realtor.com, puts it:

“While national prices continued to climb, local market conditions have become increasingly fragmented…This regional divide is expected to continue influencing price dynamics and sales activity as the fall season gets underway.”

That’s why the most brilliant move, whether you’re buying or selling, is to lean on a local agent who’s an expert on your market.

They’ll have the data and experience to tell you whether prices in your area are holding steady, moving up, or softening slightly – and how that could impact your move.

Bottom Line

Headlines calling home prices flat may be grabbing attention, but they’re not giving you the whole picture.

Has anyone taken the time to walk you through what we’re seeing right here, right now?

If you want the real story about what prices are doing in our market, let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link