For 80 years, Veterans Affairs (VA) home loans have helped countless Veterans buy a home. However, despite many veterans having access to this powerful program, the majority are unaware of one of its core benefits.

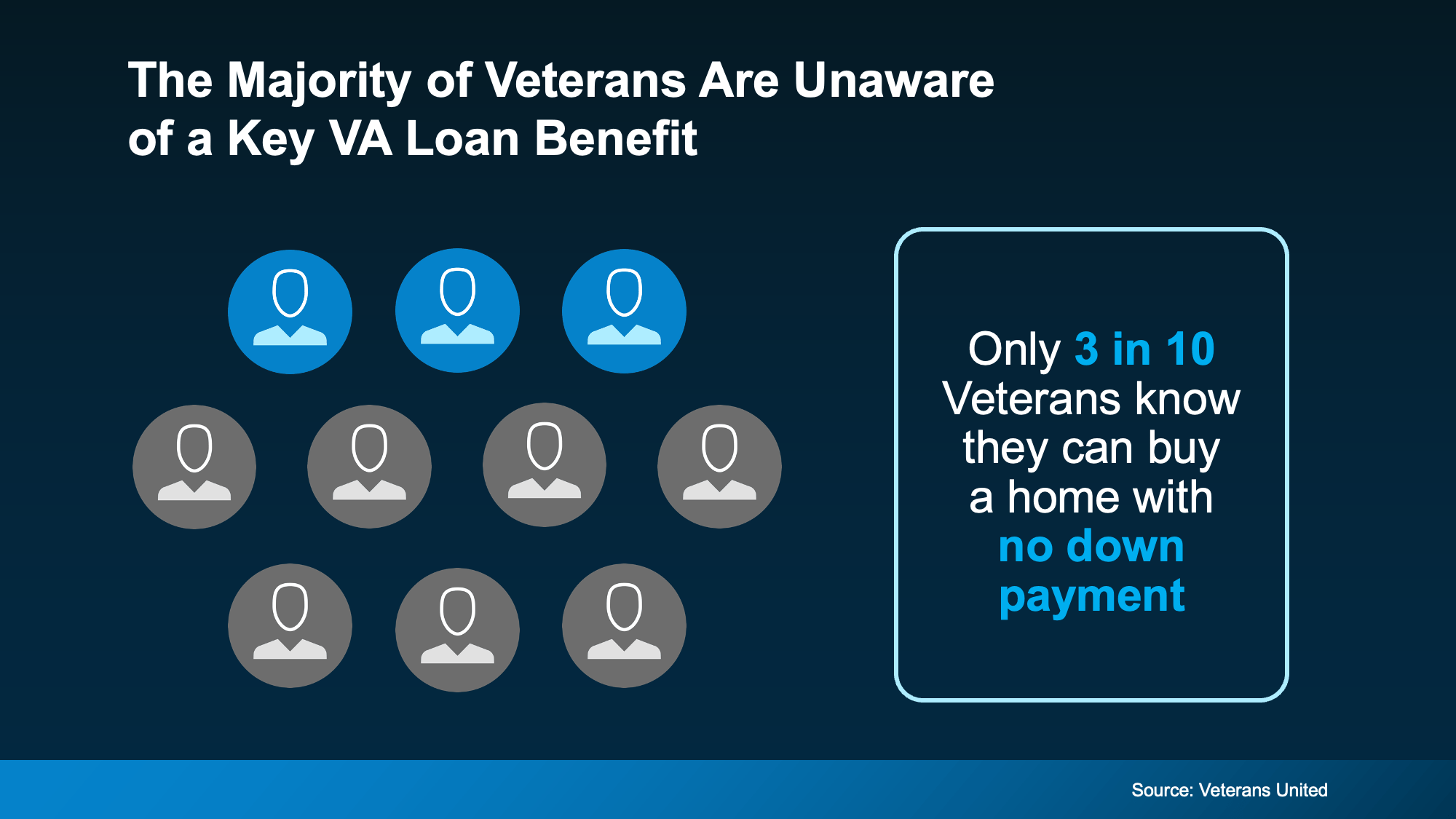

According to a report from Veterans United, only 3 in 10 Veterans are aware they may be able to buy a home with no down payment with a VA loan (see visual below):

That means 7 out of every 10 Veterans could be missing out on a key homebuying advantage.

That means 7 out of every 10 Veterans could be missing out on a key homebuying advantage.

That’s why it’s so crucial for Veterans, and anyone who cares about a Veteran, to be aware of this program. As Veterans United explains, VA home loans:

“. . . come with a list of big-time benefits, including $0 down payment, no mortgage insurance, flexible and forgiving credit guidelines and the industry’s lowest average fixed interest rates.”

The Benefits of VA Home Loans

These loans are designed to make buying a home more achievable for those who have served. And, by extension, they also allow their families to plant roots and build equity in a home of their own. Here are some of the most significant advantages of this type of loan, according to the Department of Veterans Affairs:

- Options for No Down Payment: One of the biggest perks is that many Veterans can buy a home with no down payment at all.

- Limited Closing Costs: With VA loans, there are limits on the types of closing costs that Veterans are required to pay. This helps keep more money in your pocket when you’re finalizing your purchase.

- No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, even with lower down payments. This means lower monthly payments, which can add up to significant savings over time.

If you want to learn more, your best resource for all the options and advantages of VA loans is your team of expert real estate professionals, including a local agent and a trusted lender.

Bottom Line

VA home loans offer life-changing assistance, and a trusted lender and agent can help make sure you understand the details and are ready to move forward with a solid plan.

Do you know if you’re eligible for a VA home loan? Talk to a trusted lender who can help you see if you’d qualify.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link