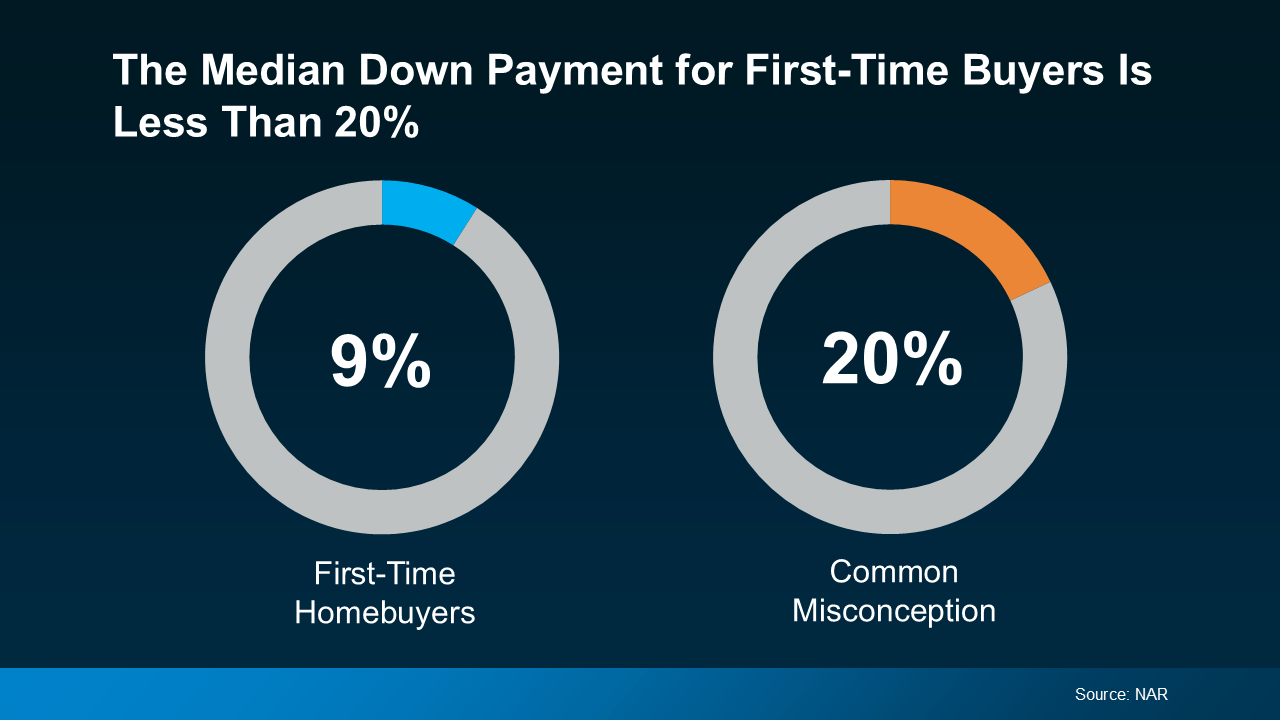

Saving up to buy a home can feel intimidating, especially now. And for many first-time buyers, the idea that you have to put 20% down can feel like a significant roadblock.

But that’s a common misconception. Here’s thHere’sh.

Do You Have to Put 20% Down When You Buy a Home?

You won’t have to unless your specific loan type or lender requires it. There are loan options designed to help first-time buyers like you get in the door with a much smaller down payment.

For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants, like Veterans. So, while putting down more money does have its benefits, it’s not essential. As The Mortgage Reports says:

“. . . many homebuyers are able to secure a home with as little as 3% or even no down payment at all . . . the 20 percent down rule is really a myth.”

According to the National Association of Realtors (NAR), the median down payment is a lot lower for first-time homebuyers at just 9% (see chart below):

The takeaway? You may not need to save as much as you initially thought.

The takeaway? You may not need to save as much as you initially thought.

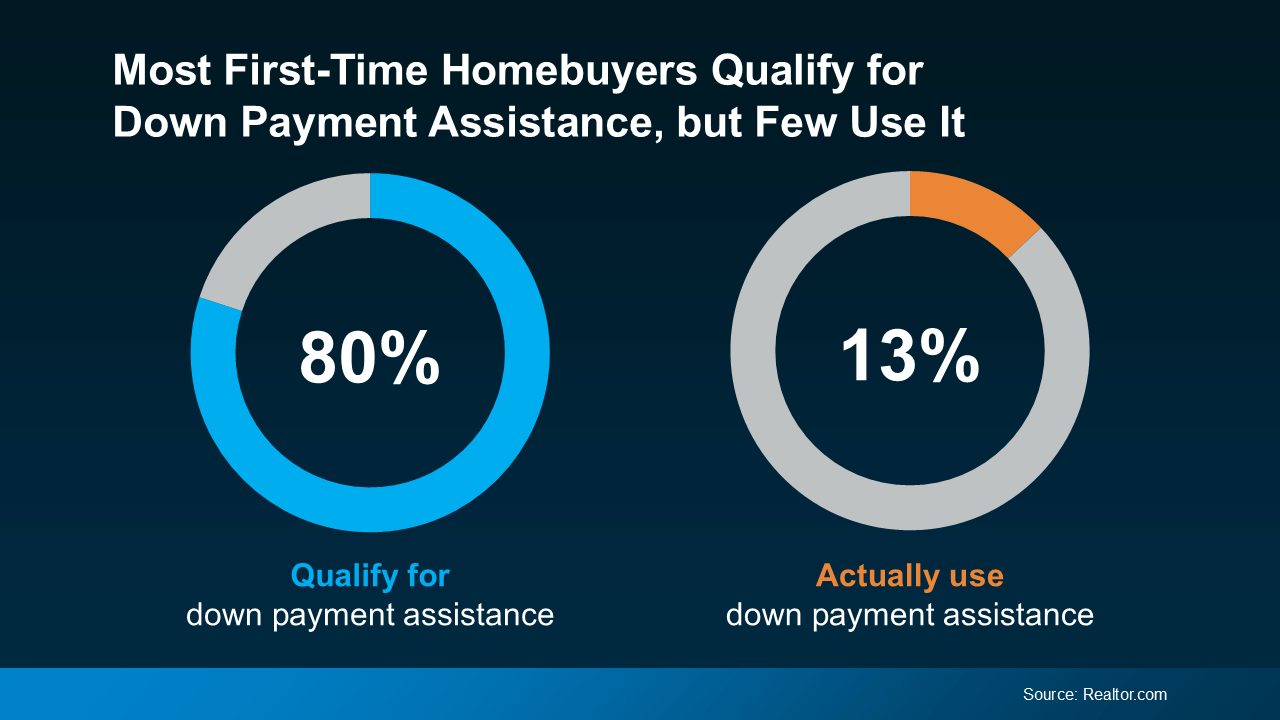

The best part is that there are also a lot of programs out there designed to boost your down payment savings. And chances are, you’re aware they’re aware they’re aware.

Why You Should Look into Down Payment Assistance Programs

Believe it or not, almost 80% of first-time homebuyers qualify for down payment assistance (DPA), but only 13% use it (see chart below):

That’s an opportunity. These programs aren’t a smaren’a tale help, either. Some offer thousands of dollars that can go directly toward your down payment. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

That’s an opportunity. These programs aren’t a smaren’a tale help, either. Some offer thousands of dollars that can go directly toward your down payment. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

“Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Imagine how much further your homebuying savings would go if you qualify for $17,000 worth of help. In some cases, you may even be able to stack multiple programs at once, giving you an extra lift. These are the types of benefits you don’t want to leave the table.

Bottom Line

Saving up for your first home can feel like a lot, especially if you’re considering putting 20% down. The truth is that many loan options require much less, and even programs are designed to boost your savings, too.

Talk to a trusted lender to learn more about what’s available and if you’d qualify for any down payment assistance programs.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link